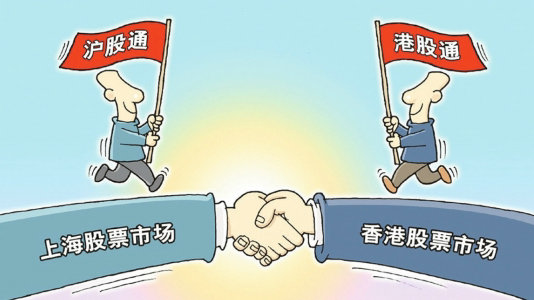

In today's podcast, analysts comment on the northbound flood of investment, versus a southbound trickle, in the just-opened Shanghai-Hong Kong Stock Connect.

在今天的播客中,在刚刚开始的沪港股票市场交易互联互通中,海外投资者要远多于大陆投资者,分析家对此给出了评论。

Trading on the first day of the Shanghai-Hong Kong Stock Connect program on November 17 saw Shanghai-listed companies receiving much more attention from overseas investors than the other way around. The pilot program allows investors in Hong Kong and on the mainland to trade stocks on the other side's bourse through securities firms in their own market. The program is part of connecting Chinese equity markets with those overseas. The daily limit for investments from Hong Kong to Shanghai in the program is the equivalent of 13 billion yuan. The limit the other way round is 10.5 billion yuan. By the time the market closed on the first day of trading, northbound limits hits their maximum limit, while southbound investments totaled 1.77billion yuan, or less than 17 percent of the daily quota. Analysts say this reflected foreign investor interest in the A-share market, as opposed to mainland apprehension regarding unfamiliar trading rules and wider fluctuations in the Hong Kong market. Some also argue that regulatory requirements have blocked many potential investors in Hong Kong-listed stocks. Credit Suisse predicted a big gap because the supply of foreign capital that can be invested in the Chinese market is strong, said Chen Changhua, head of the firm's China Research Department. He went on to say that the two sides have a gap in terms of capital strength, with foreign investors more ready with capital to enter the Chinese market. The regulations for the Hu-GangTong say mainland investors must have at least 500,000 yuan to join the program. This means many potentialinvestors from the mainland have been shut out, analysts say. In addition to this, channeling capital to Hong Kong for investment through casinos and underground currency exchange facilities costs less than the Hu-Gang Tong, said Hong Hao, chief strategist of BOCOM International. Before regulators in the central government and Hong Kong tightened rules against such illegal practices, they had been a major channel for wealthy mainlanders to move funds overseas.

沪港股票市场交易互联互通开始于11月17日,人们注意到海外投资者更关注上海的上市公司。这样的试点项目可以使来自香港和大陆的投资者在本地所在的证券交易所进行股票往来。这种项目也能够让中国的股票市场与海外相连接。香港在上海的每日投资限定额是130亿。而上海在香港的投资时105亿。截止到第一天的交易量,海外向大陆的投资达到了当天的峰值,而大陆的投资是12亿7千万,比每日的配额减少了17%。分析人士指出海外投资者对A股市场更感兴趣,相比之下,大陆投资人不熟悉交易原则,香港市场也存在较大的起伏性。许多人认为规范性的要求阻挡了许多在香港投资的投资者。瑞信预计由于向中国投资的海外资本非常强大,这也使得两地的投资差距扩大,瑞信中国研究主管陈昌华说。他还说双方在资本、实力上有明显的差距,外国投资者更想在中国投资。沪港通的规定中说大陆投资者的投资资金至少要达到50万元。这就意味着许多有实力的投资者被拒之门外。除此之外,通过赌场以及地下外汇交易所进行的投资比沪港同要便宜多,这是交银国际分析师宏皓所作出的评论。在中央政府制定政策之前,香港也对非法投资进行了严格管控,这样的非法行为已经成为大陆投资者向外投资的主要途径。

For Caixin Online, this is Diana Bates.

这是戴安娜·贝茨为您带来的财新新闻。

译文属可可英语原创,未经允许,不得转载。