Who remembers the sound of unwrapping a new record album, the smell of a new car or the thrill of opening the front door to a newly purchased home? At different points in my life, each one stood for the joy of possession, and the sense of having really arrived.

谁还记得拆开一张新唱片的窸窣声、一辆新车的味道或者打开一套新居的大门时的激动之情?在我人生的不同时刻,每一个都代表着拥有的喜悦,那种拥有的感觉是实实在在的。

My teenaged children and their peers do not see things the same way. They would rather pay for Spotify and Netflix subscriptions that let them play selections from huge online music and video catalogues than purchase DVDs or permanent downloads of a smaller selection of titles.

我十几岁的孩子和他们的同龄人对待物品的态度却与我不同。他们更愿意成为Spotify和Netflix的付费会员,他们可以从浩大的在线音乐和视频目录中任意选择播放,而不是购买DVD或永久下载数量较少的曲目或视频。

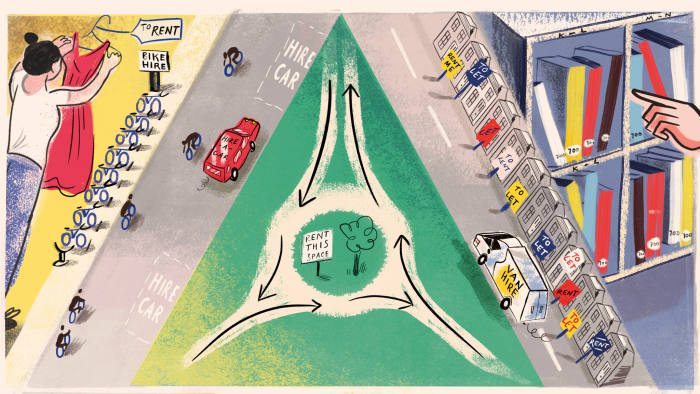

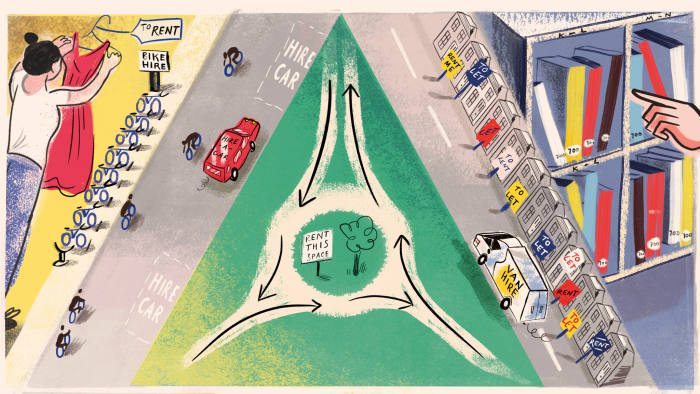

Streaming is at the forefront of a trend that threatens to upend a much wider range of industries. Technology-based groups are encouraging consumers to rethink their approach to everything from textbooks and party dresses to housing and transportation. The changes come in several categories. Platform apps are linking owners of goods and services — bicycles, spare bedrooms, even solar energy — to a host of potential users. And companies that traditionally focused on selling their wares, including clothing retailers and carmakers, are now exploring subscription and rental options.

流播放处于一种趋势的前沿,这种趋势将颠覆更多行业。科技集团正鼓励消费者重新思考他们对一切事物的态度,从教科书和礼服、到住房和交通。这些变化出现在多个领域。平台应用正把商品和服务(单车、闲置卧室甚至太阳能)的所有者与大量潜在用户连接在一起。传统上关注于销售商品的公司(包括服装零售商和汽车制造商)现在正探索会员制和租赁选项。

Taken together, the growth of these services suggests that we are entering an era in which consumers will value access over ownership and experiences over assets. The new US tax reform law may well help push the process along because it shrinks the two biggest tax breaks that encourage Americans to own their homes — homebuyers will only be able to deduct the interest on the first $750,000 of the mortgage on their houses and the deduction for state and local property taxes is capped at $10,000. Without those benefits, people who live in high-cost, high-tax areas may well decide to keep on renting. The cresting of British house prices at levels that are not affordable for most ordinary people is likely to have a similar effect in parts of the UK.

总而言之,这些服务的增多表明,我们正进入一个新时代:消费者更重视使用而非拥有,更重视体验而非资产。美国新出台的税改法案将极大地推动这一进程,因为它缩减了鼓励美国人拥有房屋的两项最大税收优惠,购房者只有头75万美元房贷的利息能够享受税收扣除,州和地方的房产税抵扣最多不超过1万美元。如果没有了这两项优惠,居住在高房价、高税收地区的人很有可能决定继续租房。英国房价升至多数普通人无法承受的峰值水平,可能也会对英国部分地区产生类似影响。

This transformation has a precedent. Many companies shifted to an asset-light model years ago — supermarkets and professional services firms sold and leased back their stores and offices, airlines started leasing rather than buying aircraft, and big tech groups such as Apple hired other companies, most notably Foxconn, to make iPhones.

这种变革是有先例的。多年前,很多公司就转向了轻资产模式:超市和专业服务机构将其门店和办公室出售然后回租;航空公司开始租借、而不是购买飞机;苹果(Apple)等大型科技公司雇其他公司生产iPhone,最引人注目的是富士康(Foxconn)。

For the most successful companies, the decision to focus on intangible assets, such as intellectual property, has been a huge boon. The move allows them to grow rapidly without having to invest in building factories or hire enormous amounts of staff. But for those at the other end of the scale, the lack of real property leaves them with little to borrow against or sell when they run short of cash. When British budget airline Monarch collapsed in October, its main asset turned out to be its UK landing slots.

对于最成功的公司而言,聚焦无形资产(例如知识产权)的决定是件好事。此举让它们得以在无需投资兴建工厂或聘用大量员工的情况下快速壮大。但对于那些小公司而言,缺乏实体资产让它们几乎无法在现金匮乏时以资产为抵押获取贷款,或通过出售资产筹措资金。当英国廉价航空公司君主航空(Monarch)去年10月破产时,人们发现它的主要资产竟然是它在英国的降落时段。

“Once companies go asset light they can scale up tremendously. But I don’t think people have really thought through the implications of consumers being asset light,” says Jonathan Haskel, professor of economics at Imperial College, who has co-written a book on the subject, Capitalism without Capital: The Rise of the Intangible Economy. “Consumers will be able to be more flexible but they will also have to change their lifestyle.”

“一旦企业实行轻资产模式,它们可以大大提高规模。但我认为人们并没有真正考虑清楚轻资产对于消费者的含义,”伦敦帝国学院(Imperial College)经济学教授、《没有资本的资本主义:无形经济的崛起》(Capitalism without Capital: The Rise of the Intangible Economy)一书作者之一乔纳森?哈斯克尔(Jonathan Haskel)表示, “消费者可以变得更灵活,但他们也不得不改变他们的生活方式。”

Those consequences are likely to be profound for both consumers and the companies that supply them.

无论是对于消费者还是为消费者服务的企业来说,这都可能带来深远的影响。

First of all, when companies are supplying services rather than tangible goods, the relationship between consumers and the things that they use becomes infinitely more complex. If I have a record album on my shelf, my husband can clearly play it. But when I link our Amazon Echo speaker to my son’s Spotify account, I have no idea whether I am violating one of the thousands of terms and conditions he agreed to with his account. Furthermore, does that act give Amazon the right to send him advertisements based on the songs we play? “Consumers are going to have to deal with the contested nature of assets. They need to figure out their rights,” says Prof Haskel.

首先,当企业提供的是服务而不是有形商品时,消费者及其所用物品之间的关系会变得极其复杂。如果我的书架上有一张唱片,我的丈夫显然可以播放这张唱片。但是当我把我们的亚马逊Echo音箱连接到我儿子的Spotify帐户时,这样做是否违反了他开通账户时同意过的数千项条款和条件中的某一条,我就不清楚了。此外,这一举动是否给了亚马逊根据我们播放的歌曲向我儿子推送广告的权力?“消费者将不得不应付资产的具有争议的性质。他们需要搞清自己的权利,”哈斯克尔教授表示。

In many cases, the shift to a sharing economy will also affect the nature of the goods that are being shared. Currently, most cars spend most of the time sitting idle. If drivers stop buying their own cars and instead sign up for a rental service or use Uber’s ride-hailing app, each individual vehicle will receive a lot more use. That means carmakers will face pressure to produce fewer, better-made cars that are able to withstand constant usage. The obvious parallel would be to supplying a laundromat versus a home: commercial machines must be faster, heavier and stronger.

在很多情况下,向共享经济转变也会影响被共享的那件物品的性质。目前,绝大多数汽车大部分时间都处于闲置状态。如果司机不再购买汽车,而是注册租赁服务或使用优步(Uber)的叫车应用,每辆汽车的使用率都将大大提高。这意味着汽车制造商将面临如下压力:生产更少、质量更好的汽车,以承受这种持续的使用。一个明显的类似例子是,供自助洗衣房使用的洗衣机和供家庭使用的洗衣机也是不同的:商用机器必须更快、更重、更结实。

Increasing the usage of durable goods such as washing machines, cars and bicycles would clearly be good for the environment and should also benefit consumers by bringing down their overall costs. It would also fundamentally reshape the broader employment market. In the sharing economy, the winners will be companies that can effectively match people and resources, rather than simply those that can sell the most goods. Jobs, meanwhile, will shift away from manufacturing and into tech and services.

提高洗衣机、汽车和自行车等耐用品的使用率,显然更环保,也会通过降低整体成本使消费者受益。这也将从根本上重塑整个就业市场。在共享经济中,赢家将是那些能将人和资源有效匹配起来的企业,而不是那些能销售最多商品的公司。与此同时,就业机会将从制造业转向技术和服务业。

No wonder carmakers Ford and General Motors have invested in Uber’s US rival Lyft, and Daimler last week snapped up French ride-booking app Chauffeur Privé. If they succeed, I may never inhale that new car odour again.

难怪福特(Ford)和通用汽车(General Motors)等汽车制造商投资了优步在美国的竞争对手Lyft,同时不久前戴姆勒(Daimler)收购了法国打车应用Chauffeur Privé。如果这些企业成功了,我可能再也闻不到新车的味道了。