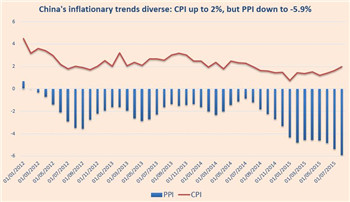

Consumer prices in China rose at their fastest pace in 13 months but factory gate prices continue to emphasise slack and overcapacity in the world's second largest economy.

8月份,中国消费价格上涨速度是13个月以来最快的,但工业品出厂价格(PPI)却继续凸显出世界第二大经济体的疲软与产能过剩。

China's consumer price index ticked up from 1.6 per cent in July to 2 per cent in August, higher than forecasts. That's the fastest rate since July 2014 but it remains well below Beijing's target of "around 3 per cent" this year.

8月份,中国全国居民消费价格总水平(CPI)的同比涨幅从7月份的1.7%升至2.0%,高于预期。这是自2014年7月以来的最大涨幅,但仍远低于中国政府为今年定下的“3%左右”的目标。

Meanwhile, producer prices not only deflated for a 42nd consecutive month, but the trend worsened to -5.9 per cent, its deepest since 2009.

另一方面,PPI不但连续第42个月下降,而且降幅还越来越大,8月份同比下降5.9%,为2009年以来的最大降幅。

"Consumer price inflation in China has been bolstered by food inflation in recent months," said Moody's Analytics before the release.

“近几个月来,中国的CPI受到了食品价格上涨的支撑,”穆迪分析(Moody's Analytics)在上述数据公布前表示。

Outside that, inflation pressures are minimal as a result of low energy prices, the still-recovering housing market, and the overcapacity across many sectors of the economy.

除此之外,通胀压力非常小,这是因为能源价格低、住房市场仍在恢复中、以及许多行业产能过剩。

The sustained decline in producer prices reflects the downturn in China's housing market, which had led to excess supply of the materials used in the housing boom.

PPI持续下滑反映出中国住房市场的低迷,这种低迷导致住房市场繁荣时期所用到的材料供应过剩。

"Producer prices remain in deflation in China, because of the high supply of raw materials and commodities and the overcapacity within much heavy industry," Moody's said. " Demand remains weak and is not likely to pick up until the housing market recovers. Meanwhile stock market ructions may have caused businesses to slow spending further in July."

“中国的工业品价格仍在下滑,这是因为原材料和大宗商品供应量大,而许多重工行业又产能过剩。”穆迪表示,“需求仍然疲弱,而且在住房市场恢复前不太可能会回升。同时,股市动荡或许导致企业在7月份进一步减少了支出。”