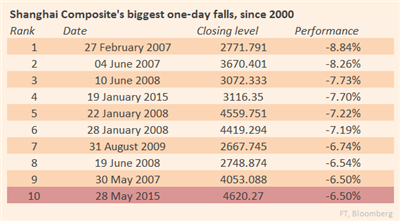

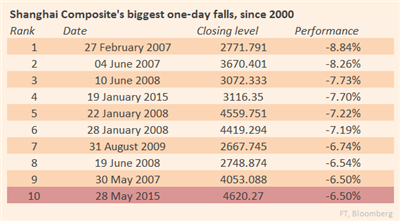

The Shanghai Composite has ended a seven-day winning streak with a bang, wiping out 6.5 per cent to record its second-worst session of 2015, or its 10th worst session in 15 years.

今日上证综指(Shanghai Composite)结束了连续7日的上涨态势,跌幅达6.5%,为2015年第二大单日跌幅,近15年来的第10大单日跌幅。

Until Thursday China's benchmark index had surged more than 50 per cent, despite widespread concerns that the market was in bubble territory. The seven session run was the longest since a 10-day run to March 24.

尽管各方广泛担心股市已进入泡沫区间,从今年年初至本周四,中国的这一基准股指已累计上涨逾50%。这次七连涨是截至3月24日的十连涨以来连续上涨时间最长的一次。

The tech-heavy Shenzhen Composite, which had more than doubled this year alone, also lost 5.5 per cent — the third biggest fall in five years.

科技股权重较高的深成指(Shenzhen Composite)仅今年以来便上涨了一倍以上。今日,深成指也下跌了6.19%。

Earlier this week, analysts at Credit Suisse offered some level-headed advice to clients who were considering investing in Shenzhen stocks: "At some point, there will be a massive correction of these stocks, in our view. Avoid this space!!!"

本周早些时候,瑞信(Credit Suisse)分析师曾向考虑投资深圳股市的客户提出了冷静的建议:“我们认为,深市将在某一时点发生剧烈回调。请注意回避!”

Market participants will be searching for a clear catalyst for the late sell-off, but it's doubtful there is one. So much of the rise this year has been based on momentum, fuelled by easing and hopes of more easing from the People's Bank of China. When selling begins, the momentum can turn quickly. Besides profit taking, a wider catalyst is hardly needed.

市场参与者将为最近的抛售行情寻找一个明显的催化剂,但是否真存在催化剂令人怀疑。今年的上涨行情主要依靠走势,而驱动走势的则是中国央行(PBoC)的宽松政策以及市场对央行进一步宽松的预期所赐。当抛售开始,走势可能迅速调头。除了获利回吐,基本上不需要影响更广的催化剂。